NYT Real Estate Event May 21st @2:30 E.T. New York Real Estate: How Low Will Prices Go?

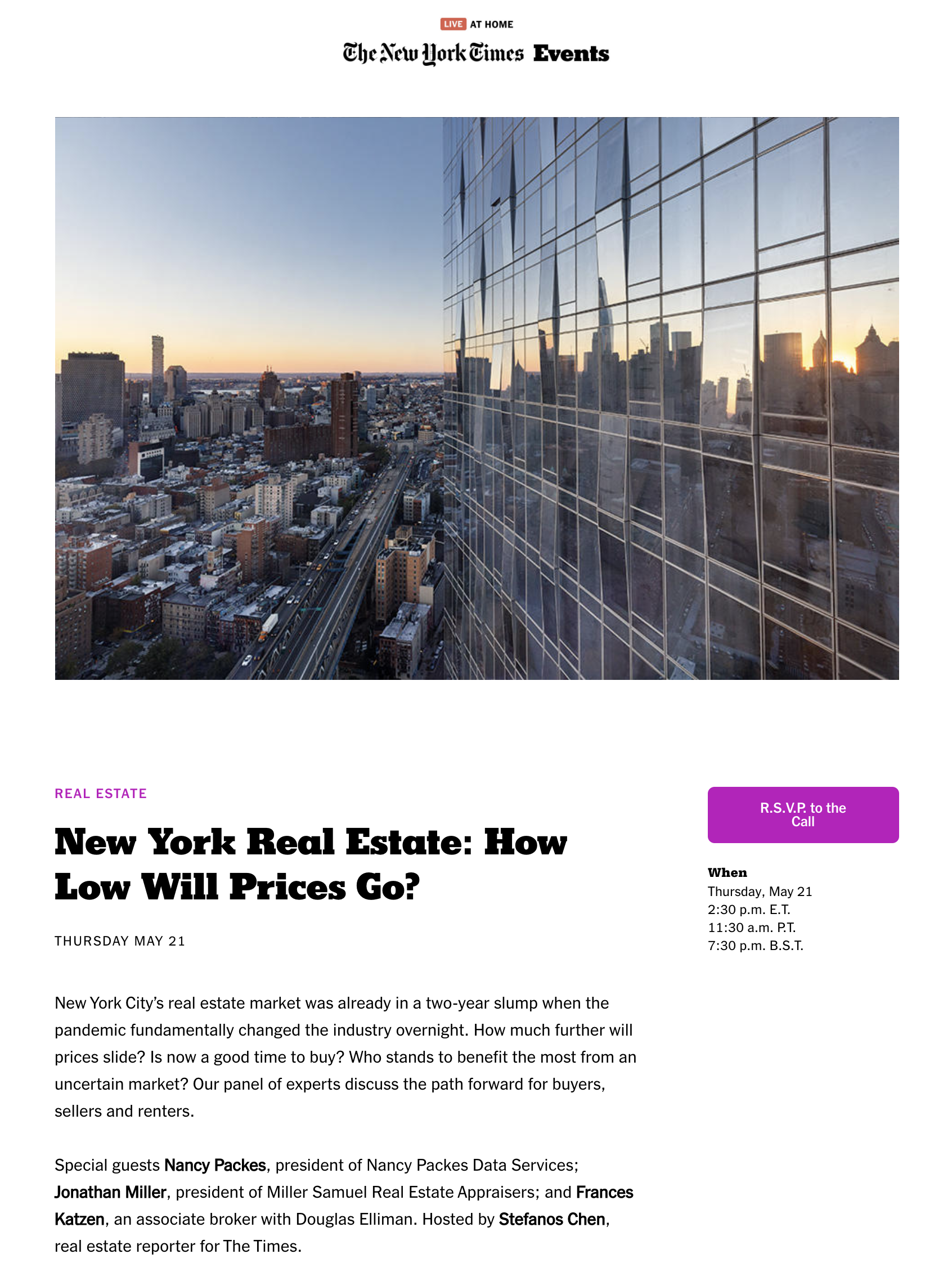

I’ve been asked to participate in Thursday’s New York Times Event New York Real Estate: How Low Will Prices Go?”.

Click on the image below to RSVP!

Tags: New York Times, NYT Real Estate, Frances Katzen, COVID-19, Coronavirus, Stefanos Chen, Nancy Packes, Zoom

Comments Off on NYT Real Estate Event May 21st @2:30 E.T. New York Real Estate: How Low Will Prices Go?

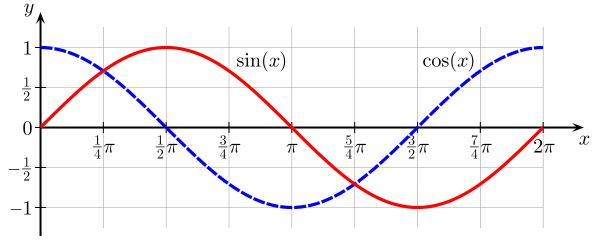

The Overstated COVID-19 Blame on Urban Density in Favor of Suburban Living

[NYC.gov]

One of the pieces of conventional wisdom we have picked up during the COVID-19 crisis is that high-density residential living will be less favored. The city to suburban migration pattern is already beginning in New York City and could last several years. The rising number of suburban single-family rental inquiries from the city has provided the initial evidence of a trend. City residents seem to be looking to test drive the suburbs and commute to their city job when “shelter in place rules begin to ease.”

Unfair Reputation?

New York City has developed a national reputation as a hotbed of Coronavirus infection because of our higher density. We live a lot closer together than a sprawling suburb in Dallas and have a greater dependency on public transportation such as the subway and buses instead of driving cars. I live in Fairfield County, Connecticut, a bedroom suburb of New York City with a county-wide COVID-19 ratio of 1068 deaths per its 943,332 population. Dallas County, Texas, had 153 deaths per its 2.636 million people. My county has a wildly higher death rate than a county that contains an urban core like Dallas.

Is the city to suburban trend sustainable?

New Yorkers buy into the urban to the suburban narrative, so I believe the push to the outlying NYC metro suburbs could be quite significant in the near term. While the outbound migration began a few years ago, it is not clear whether the trend can continue for more than a few years. The pattern could ultimately be different from what is currently expected including:

- A boost for second-home markets: There might be an influx of demand to areas the Hudson Valley, Northern Connecticut The Hamptons, and the North Fork, to name a few. Consumers made begin to view a second home as an equal asset to the primary home to have similar quality options. This potential trend would be contrarian to other significant economic downturns as second-homes are not considered “second-priority.”

- And because the implications of the SALT tax will remain in place on the other side of the COVID-19 crisis, Florida and Texas can make a compelling pitch to New York City couples with small children cooped up in 1,000 square foot 2-bedroom apartments right now. They are realizing they aren’t as tethered to their work location as they once thought – and schooling via Zoom is not all it’s cracked up to be.

I think that the high-density lifestyle of New York City is what makes living there so great. I’ve lived in or around New York City since the mid-80s. Before we moved to the city, my dad used to proclaim:

Where else can you buy strawberries at 3 am in the morning?!?!?

Placing strawberries aside, I remain skeptical that the urban to suburban outbound migration can be sustained long term. We saw the same outbound pattern after 9/11 and then an inbound return only a few years later.

Density is not the only reason

Urban density is just one reason for the high COVID-19 infection rate that is driving outbound migration. It is not the reason. Other factors influencing the disparity in the infection rate include neighborhood characteristics such as wealth, commute time, and the concentration of multi-generational households.

The map above confirms the argument that it’s not all about density – the highest infection rates are in the “suburban-like” areas of the city including Staten Island and the outer reaches of Brooklyn and Queens. Manhattan, home for many of the tall commercial and residential towers the city is famous for, has the lowest infection rate.

These Manhattan results might help maintain the enthusiasm for that occasional 3 am strawberry run to the corner market.

Tags: Manhattan, NYC, COVID-19, Coronavirus, Urban to Suburban, Strawberry

Comments Off on The Overstated COVID-19 Blame on Urban Density in Favor of Suburban Living

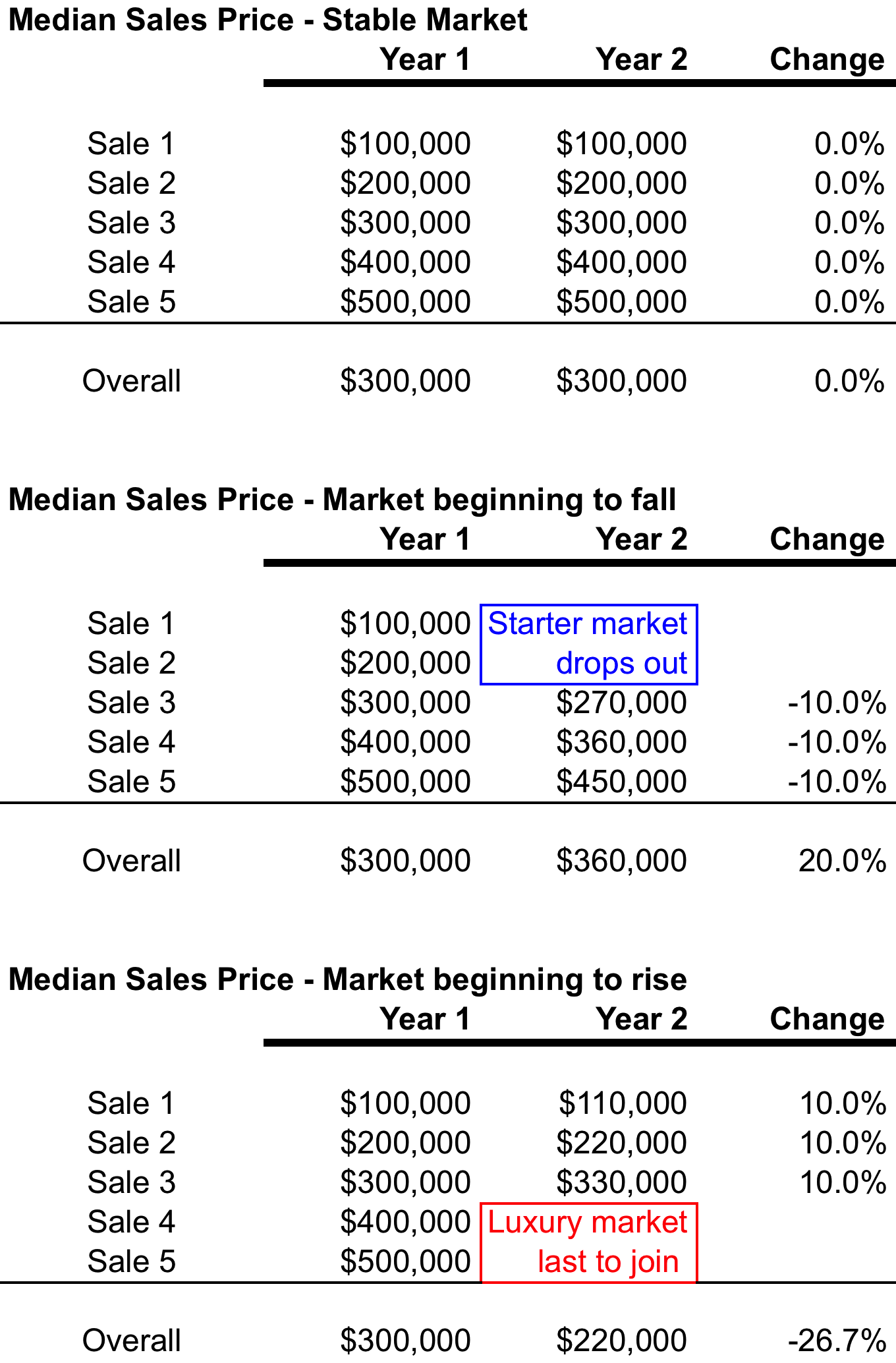

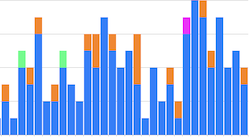

Median sales price can be subject to skew by consumer behavior more than math

Here’s an updated excerpt from my Housing Note newsletter dated October 28, 2016, digging into the median sales price. You can subscribe to Housing Notes and other housing resources for free.

I wrote about the median sales price a decade ago, and the message still holds. A couple of years ago, I whipped up a table that shows how median sales price can perform in a changing housing market. The median sales price is the default price trend indicator of real estate because it eliminates the extreme highs and lows of a data and merely represents the middle number. However, it is also subject to skew by consumer behavior that can overpower the math. So I always provide two to three price trend indicators depending on the quality of available information (average sales price, median sales price, median sales price) for all of the reports in my Elliman Report Series. The relationship between median and average sales price can also tell a story.

Click on the graphic below to expand.

Tags: median sales price, skew

Comments Off on Median sales price can be subject to skew by consumer behavior more than math

Manhattan Crisis: What Does Our Housing Past Tell Us About Our Housing Future?

In this Sunday’s New York Times Real Estate Section (online now), the Calculator column featured some data trends I’ve gathered during two significant prior housing market events: What Can 9/11 and the Great Recession Tell Us About Coronavirus Recovery?

Tags: New York Times, 9/11, financial crisis, Lehman Brothers Bankruptcy, NYT Real Estate, Michael Kolomatsky

Comments Off on Manhattan Crisis: What Does Our Housing Past Tell Us About Our Housing Future?

ABC World News Report 5-2-20 ‘Urban to Suburban’

If you can indulge me, I was included in the ABC World News Tonight broadcast on Saturday night to talk about the potential urban to suburban housing shift, particularly in NYC. It was cool to be interviewed by Deirdre Bolton for her first World News Tonight segment since just joining ABC via Fox Business and previously from Bloomberg where I had spoken with her before. Great move ABC!

Tags: Deirdre Bolton, COVID-19, Coronavirus, ABC World News Tonight, ABC TV

2 Comments

Contract Data Is Pending Data Is Lagging Data

In our post-Coronavirus world, it is clear that market conditions and our understanding of the future are subject to change every day. In my prior post Establishing the COVID-19 Demarcation Line: From ‘Hanks To Banks’, data that falls after the line represents a different market.

So how do we determine what data falls in after the demarcation line? It’s not as straightforward as it sounds.

Throughout my career, I have seen brokerage firms publish pending/contract reports, touting pending trends as more reliable than reports based on closings. I don’t look at them as better or worse, just a different way to look at the market. The simplistic, uninformed argument for pending sales is that contract dates occur before closing dates, so they are more current. Incidentally, contract prices are not readily shared. I get all of this. Yet I have seen the failure rate of contracts be as high as 40% – in other words, many contracts might not close whereas closing reports are solely based on successful transactions. Still, pending sale trends are useful as long as the reader understands their shortcomings. I plan to develop one someday.

Closing data and contract/pending data lags the “meeting of the minds.“

Meeting of the minds (also referred to as mutual agreement, mutual assent, or consensus ad idem) is a phrase in contract law used to describe the intentions of the parties forming the contract. In particular, it refers to the situation where there is a common understanding in the formation of the contract.

While we know that closing dates lag the “meeting of the minds,” we also need to understand that signed contract dates are lagging indicators, often by 2-4 weeks. During this crisis, I’m speculating the failure rate will be high initially, and the time lag will be on the longer end rather than, the shorter end of this 2-4 week range.

Here’s why contract dates are a lagging indicator and not necessarily more insightful than closing data:

1) The “meeting of the minds” occurs when buyers and sellers negotiate price and terms, usually facilitated by a real estate agent or broker.

2) The price and terms are handed off to transaction attorneys who work together to craft language agreeable to both parties.

3) The contract is signed by both parties and often indicated as such in an MLS-type system.

4) In some markets or marketing periods, especially when a market is cooling, many contracts never close, so their initial inclusion makes pending trends reports suspect.

If there is a four week signed contract lag from the meeting of the minds, and considering the March 15 demarcation line for post-Coronavirus, that means that with us being six weeks into the crisis, we are only able to see two weeks worth of post-Coronavirus data. And even with that reality and current shelter in place rules, many current contracts might have been older deals that were facilitated by the buyer who had already inspected the home in January/February – we are seeing some of that now.

In other words, relevant data on the new market remains extremely limited.

Tags: Contracts, Pending, data lag

Comments Off on Contract Data Is Pending Data Is Lagging Data

Establishing the COVID-19 Demarcation Line: From ‘Hanks To Banks’

This topic was explored in last Friday’s Housing Notes.

In order to understand what is happening now, we need to ween ourselves off of what happened before this crisis and focus on finding data exclusive to the post-COVID-19 era. In Manhattan, that data set is not yet apparent because we are in nearly a total market shut down but it is evident elsewhere to a limited degree. From my perspective, the demarcation line for the onset of the crisis is where market participants would have to be living in a cave on a desert island to be unaware of the sharp pivot in market sentiment.

March 15, 2020

I believe that date is March 15th which is the date of the Federal Reserve federal funds rate cut to zero and was their second cut in less than two weeks.

March 11, 2020

My friend and California appraiser Ryan Lundquist proclaimed March 11th which was the date Tom Hanks announced he and his wife had contracted COVID-19. Phil Crawford of Voice of Appraisal said the demarcation line was March 5, 2020 dubbing it “data point zero” and I had originally said the demarcation line was March 3, 2020, on the day of the 0.5% rate cut in March.

I was talking about this difference in these dates with a friend, Chicagoan, and RAC appraiser Michael Hobbs who brilliantly dubbed this four-day window from March 11 to March 15 as: “From Hanks To Banks.”

And if you do the math, the median and average date of March 11 and March 15 is literally Friday the 13th so what more confirmation of a demarcation line do you need?

Whatever your specific local demarcation line is, use it to keep the data for these two market periods separate.

Tags: COVID-19, Coronavirus, Demarcation Line, Hanks to Banks

Comments Off on Establishing the COVID-19 Demarcation Line: From ‘Hanks To Banks’

Do We Hope This Listing Goes Viral?…No We Don’t.

I am reading a lot more about everything right now, including real estate. Yesterday’s Bloomberg article caught my eye: Greenwich Homeowner Bets on Virus Getaway Pitch to Win a Sale. Desperation to sell can take many forms. Please read on.

The article featured a listing in Greenwich, CT that came on 68 days ago that wasn’t moving (I assume this based on what was done later). Here is the text for the original listing displayed at the bottom the screenshot:

Like new light-filled house with a modern design by Donald Breismeister including 9 ft ceilings on the first floor. High-tech amenities throughout with e-thermostat, lighting and security cameras all hardwifred CAT-5 wiring throughout. Bathrooms are beautiful and modern with separate steamshower and large whirlpool tub. Nice front yard and backyard has large entertainment deck. All these amenities are just two blocks from the Post Road on a quiet road within walking distance to GreenwichHS, Greenwich Country Day and Central MS.

With the sales market slowing down despite entering peak selling season, many homeowners are reluctant to add their homes to the rental market. The owner in the article said:

“I rented property in the past. It’s too much hassle. My trust level is pretty low with renters.”

About ten days ago the listing was modified by raising the price to $100,000 and throwing in a 2011 Subaru, linens, televisions, etc. and rebranding the sales effort as a Coronavirus Special (bold emphasis mine).

CORONAVIRUS SPECIAL – Some houses are move-in ready. This house is live-in ready. It comes with all furniture, kitchen appliances, washer & dryer, dishes, silverware, TVs, pool table, beds, linens, lawn equipment and even a car. Everything you need to enjoy living in your own house in Greenwich. The house was designed by an award winning architect with lots of custom features. The first floor has high ceilings and two fireplaces. You have a Costco closet just off the 2-car garages and 5 BRs upstairs.You have town water, gas and sewer and are close to both public and private schools. Tomney is a quiet side street, but near downtown, the train and I-95.If you don’t want the time and hassle of arranging movers and buying lots of new items, this house is ready for you now.

While I very much appreciate how hard it is right now to market a home for sale during a global pandemic, the marketing of a home as a CORONAVIRUS SPECIAL is a bit tone-deaf especially when raising the price to include a bunch of the seller’s personal stuff. “Throwing in” used furniture, appliances, linens and an old car by raising the listing price by $100,000 is not, by definition, “throwing it in.”

When I first saw the listing in the Bloomberg piece I thought about all the snarky headlines during other pandemics/tragedies and using brutal sarcasm I found myself chuckling from the absurdity of all of it. Now, as I was writing this post a day later, the initial LMAO title ideas felt icky and were not worth repeating.

Q: Can you imagine associating the word “SPECIAL” with these?

- AIDS

- SARS

- H1N1

- 9/11

A: I didn’t think so.

Times like this call for creative marketing and perhaps the Bloomberg story and even this blog post may bring new eyeballs to the listing to help it sell. I suspect that won’t happen because the appearance of the home and what comes with it for the price isn’t the problem. The agent is definitely not the problem. The seller is definitely not the problem. The problem is the sudden change in the world we live in and the understanding that it will take time to adapt. Our initial impulses to take action, such as this situation, are often wrong.

Tags: Coronavirus

2 Comments

More Bloomberg Media Hits On Real Estate and the Coronavirus

If you missed this week’s Housing Notes, here are two Bloomberg clips (from radio and TV) where I break down the state of the market post-Coronavirus:

Bloomberg Radio: Surveillance – ‘Jonathan Miller…details how the housing market is dealing with fallout from the coronavirus.’

I spoke with Tom Keene and Lisa Abramowicz on Bloomberg Radio’s morning show “Surveillance” on the state of the housing market.

The full segment is a great listen. My interview starts at 21:33.

Bloomberg TV: Markets – ‘Manhattan Home Sellers Hold Back Listings During Coronavirus’

I joined network Vonnie Quinn in New York to talk about the state of the market since the coronavirus hit. She is always wonderful to speak with. The stock photo they used for me was taken about 15 years ago (when I was 15, obviously). At the last second, they had me speak through their London bureau for technical reasons, so each question and answer saw a small delay. The interview was based on this Bloomberg article: Manhattan Home Sellers Hold Back Listings in Coronavirus Retreat:

Tags: Tom Keene, Bloomberg Surveillance, Bloomberg Radio, Vonnie Quinn, Bloomberg Markets, Lisa Abramowicz, Coronavirus

Comments Off on More Bloomberg Media Hits On Real Estate and the Coronavirus

Bloomberg Radio’s Barry Ritholtz – Masters in Business Show: Jonathan Miller on Real Estate After the Coronavirus

I joined my friend, columnist/blogger at Big Picture and Bloomberg Radio host Barry Ritholtz to talk about the housing market before and after the Coronavirus crisis on his must-listen radio and podcast show Masters in Business. He interviewed me in 2014, 2016 and now, 2020.

I rationalized that the long gap since 2016 was because he was interviewing other Millers on his show, Steve Miller of the Steve Miller Band and Bill Miller of Legg Mason Capital Management. Ha.

Barry’s show is always a good listen and has long been part of my podcast feed. I’ve received quite a few shoutouts from people who were listening to the show in their cars.

Tags: Bloomberg Radio, Barry Ritholtz, The Big Picture, Master in Business

Comments Off on Bloomberg Radio’s Barry Ritholtz – Masters in Business Show: Jonathan Miller on Real Estate After the Coronavirus

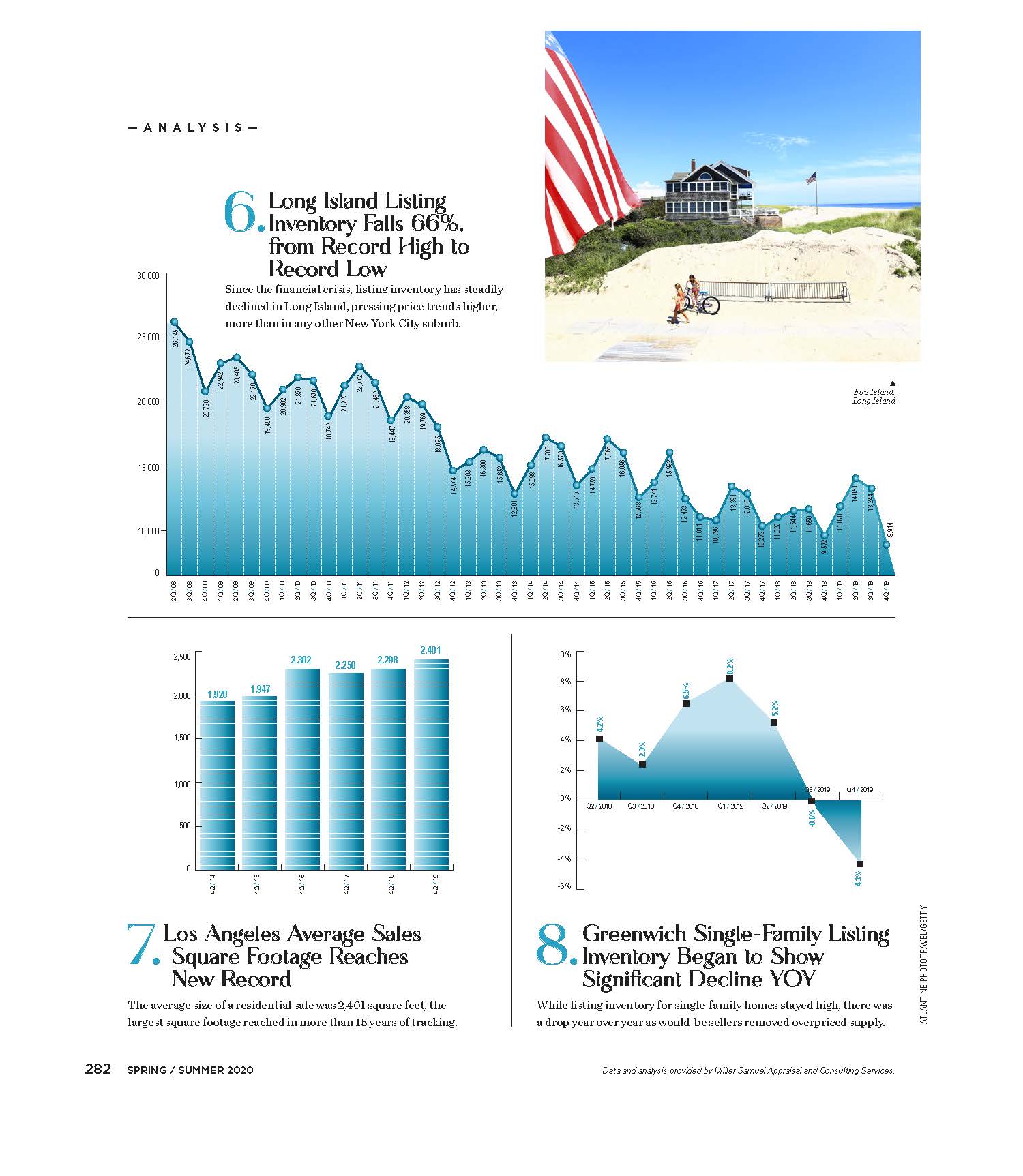

Elliman Magazine: 8 Regional Housing Market Charts

I whipped up eight charts using data from our expanding Douglas Elliman Market Report Series to touch base on a wide array of U.S. housing markets. These charts appeared on pages 280-282 in the 2020 Spring/Summer edition of Elliman Magazine. Click on each graphic to expand.

Tags: Elliman Magazine, Townhouses, Cash, Los Angeles, Greenwich, Downtown Boston, Miami Beach, Long Island, Aspen, Market Update

Comments Off on Elliman Magazine: 8 Regional Housing Market Charts

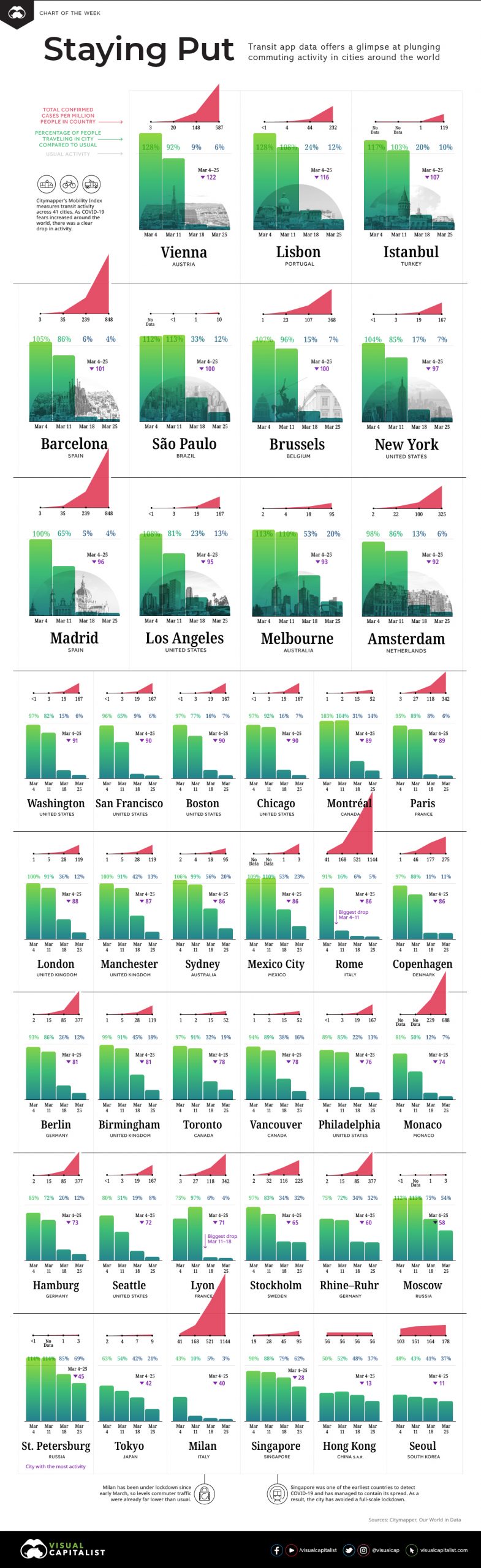

Staying Put Locally = Saving Lives Globally

Visual Capitalist created a terrific infographic of 41 cities around the globe comparing the outbreak trend against the commuter activity trend. Incredible

Tags: Visual Capitalist, Iman Ghosh

If you haven’t already, sign up for ‘Housing Notes’ to receive weekly insights and research.

If you haven’t already, sign up for ‘Housing Notes’ to receive weekly insights and research.

Favorite “How to Value” Posts

Favorite “How to Value” Posts

RECENT COMMENTS ON MATRIX